Life Insurance in and around Santa Clarita

Get insured for what matters to you

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

Choosing life insurance coverage can be a lot to consider with several different options out there, but with State Farm, you can be sure to receive reliable empathetic service. State Farm understands that your ultimate goal is to protect the ones you hold dear.

Get insured for what matters to you

Now is a good time to think about Life insurance

State Farm Can Help You Rest Easy

But what coverage do you need, considering your situation and your loved ones? First, the type and amount of insurance you decide on can be designed to integrate your current and future needs. Then you can consider the cost of a policy, which is calculated using how old you are and your physical health. Other factors that may be considered include occupation and personal medical history. State Farm Agent Brian Stephens can walk you through all these options and can help you determine how much coverage is right for you.

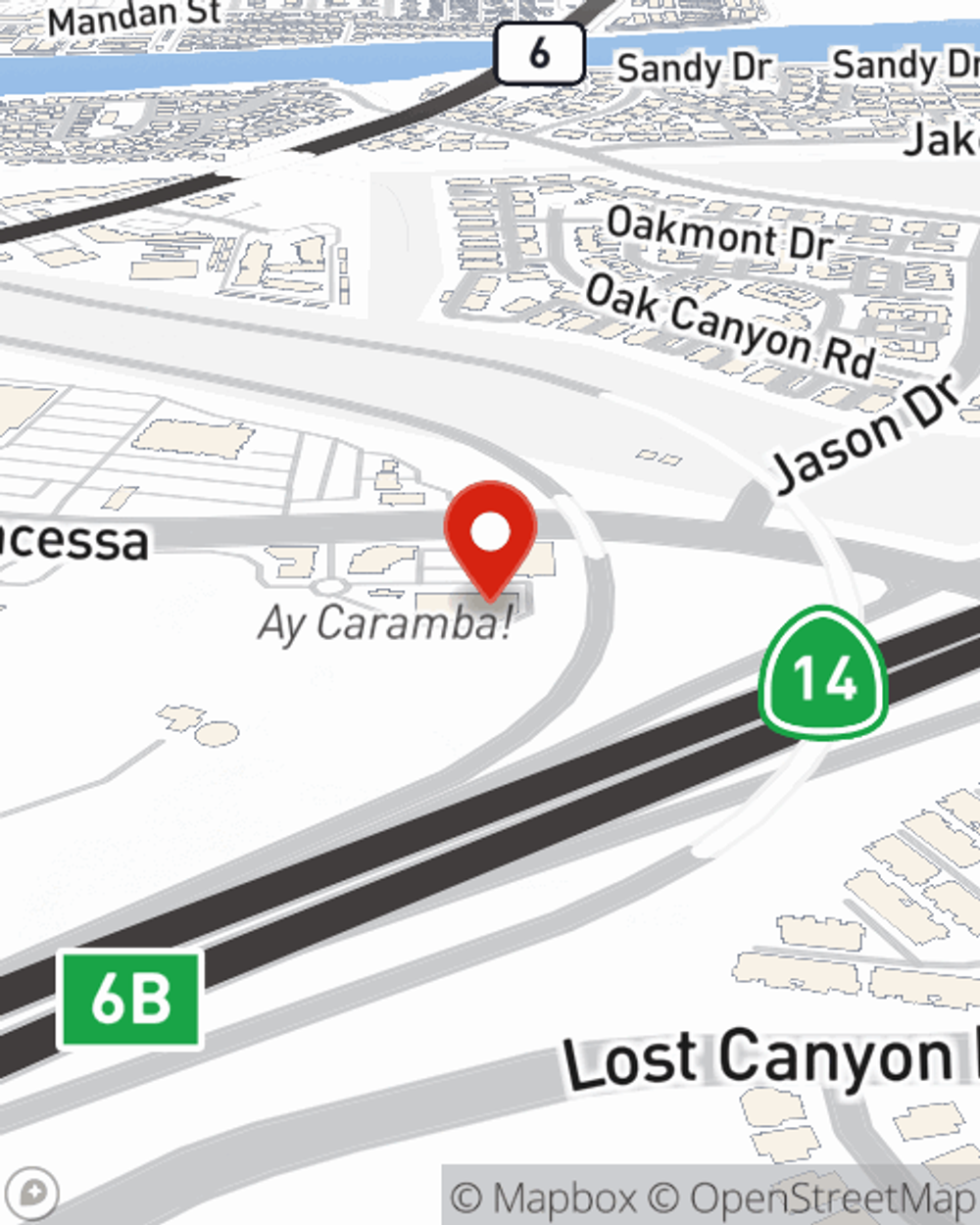

Contact State Farm Agent Brian Stephens today to discover how the leading provider of life insurance can ease your worries about the future here in Santa Clarita, CA.

Have More Questions About Life Insurance?

Call Brian at (661) 424-0800 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Brian Stephens

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.